It’s been over a decade since medical cannabis became legal in Illinois, and nearly five years since recreational cannabis followed suit. While overall sales figures boast significant growth, a closer look reveals a struggling landscape for new shops and brands, while multi-state operators (MSOs) continue to dominate. The state’s recent pause on the next round of social equity licenses, intended to help smaller businesses, raises questions about its effectiveness in a market riddled with high taxes and restrictive regulations.

1. The Looming Tax Problem

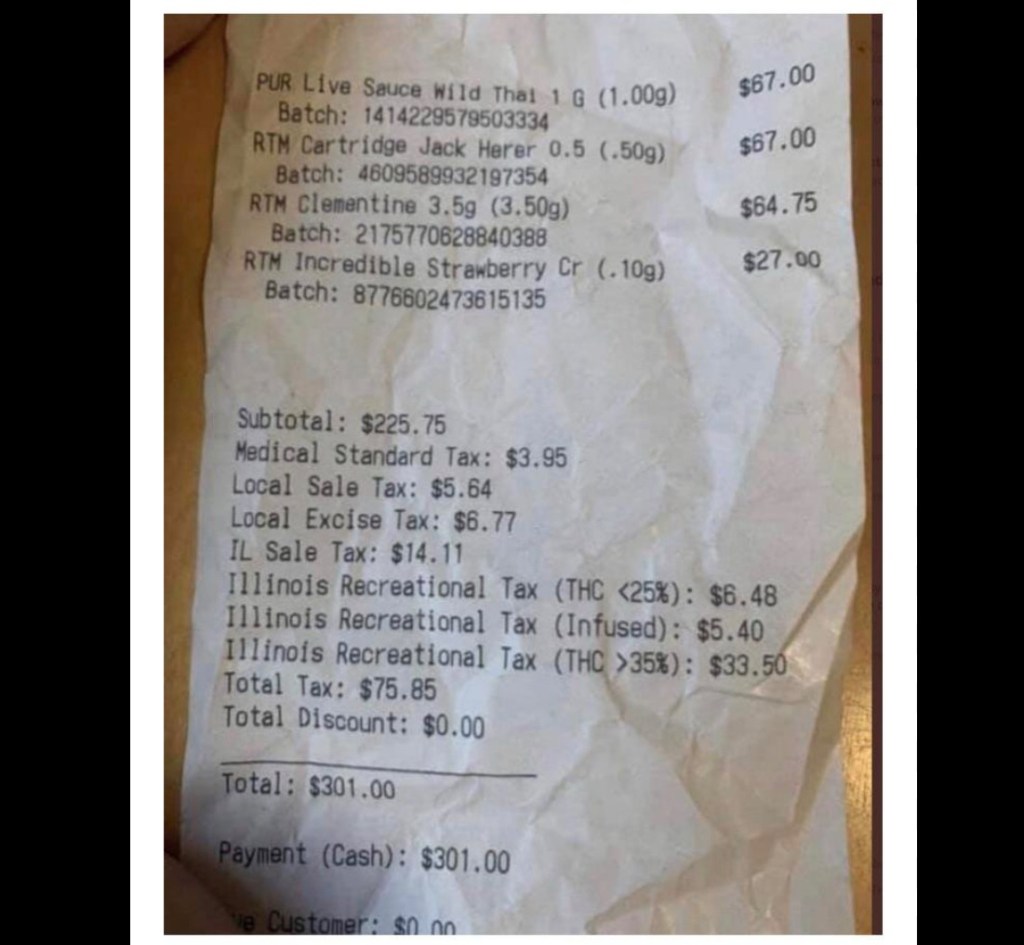

One of the most significant hurdles for the Illinois cannabis market is its exorbitant tax structure. Working in dispensaries, the main complaint heard from consumers is the shock at checkout. What seems like a reasonable price on the shelf quickly inflates by as much as 40% once taxes are applied. This steep increase drives many consumers to neighboring states like Michigan and Missouri, where taxes are significantly lower, and products often offer higher doses at a more competitive price point.

Illinois’ cannabis tax rates are complex:

- 10% for flower or products with less than 35% THC.

- 20% for infused products like edibles.

- 25% for products with a THC concentration higher than 35%.

On top of these, the state’s regular 6.25% sales tax and local taxes (up to 3.75%) are added, pushing the total retail tax burden to between 19.55% and 34.75%, depending on the product’s potency. This is considerably higher than Michigan’s flat 10% excise tax plus a 6% sales tax, or Missouri’s 6% excise tax and 4.2% sales tax.

2. A Call for Medical Patient Flexibility

Currently, medical cannabis patients in Illinois are largely confined to a shrinking number of medical-only dispensaries. With no immediate plans to issue more medical dispensary licenses, this forces patients to travel further and limits their access to a wider variety of products. To alleviate this, Illinois should consider:

- Allowing medical patients to shop at any recreational dispensary in the state.

- Applying the medical tax rate for these purchases, recognizing their patient status.

This would not only improve accessibility for medical patients but also boost sales for recreational dispensaries.

3. The Demand for Higher Dose Edibles

Both recreational and medical cannabis users in Illinois are looking for higher dose edibles. The current limits often force consumers to purchase multiple packages to achieve their desired effect, whether for recreational use or pain management. Legislators in Illinois should consider creating legislation that would allow for 200mg of THC in edible products. This would greatly benefit individuals with higher tolerances or those seeking more potent treatment for chronic conditions.

Currently, Illinois residents are limited to purchasing recreational products containing a total of no more than 500mg of THC in cannabis-infused products. Medical patients have a higher allowance of up to 2.5 ounces (70.87 grams) every 14 days, with the possibility of a waiver to increase this to 5 ounces every 14 days. However, individual edible packaging typically remains at 100mg.

4. Reconsidering Social Equity Licenses and MSO Dominance

The state’s decision to pause the issuance of new social equity licenses is a controversial move. While the stated aim is to help existing social equity licensees gain a stronger footing, many argue it simply perpetuates the dominance of established Multi-State Operators (MSOs). These larger companies have cornered the market since its inception, making it incredibly difficult for smaller, independently owned social equity businesses to compete.

Despite social equity applicants receiving 65% of licenses granted in 2023, they only accounted for 11.9% of total cannabis sales in a state-commissioned disparity study from 2024. This highlights the ongoing challenges faced by these businesses, often stemming from limited capital and the inability to sell medical cannabis, a right currently reserved for MSOs. As of May 2025, only 68 out of 199 social equity dispensaries were operational.

Pausing licenses punishes new license holders who have invested time and resources waiting for their opportunity. It only serves to further entrench the control of MSOs, hindering the very equity and diverse market that was initially promised. For Illinois to truly foster a thriving and equitable cannabis market, it needs to rethink its approach to taxation, patient access, product offerings, and the fair distribution of opportunity.

What are your thoughts on the Illinois cannabis market? Share your comments below!

Don’t miss out on more insights and updates from Couch Lock’d! Like this post, and subscribe to our newsletter here for exclusive content delivered straight to your inbox.

Stay in the loop with all things Illinois Cannabis by joining the Couch Lock’d Newsletter here!

Become a Couch Lock’d Member.

Want to meet more people in the community and see what everyone’s smoking on? Join our Telegram channel here.

Find our latest reviews here.

Hosting an event & need a consumption bar? Hit us up here.

Save money with our affiliate links here.

Get your Illinois Medical Card for $85 with our link here.