Illinois’ cannabis market is a powerhouse, boasting over $2 billion in sales and nearly half a billion in tax revenue in 2024. Yet, recent moves to pause new social equity dispensary licenses, intended to help these businesses get on their feet, might be missing the real issue. Instead of holding back progress, Illinois lawmakers should be focusing on a more fundamental problem: the state’s incredibly high cannabis taxes.

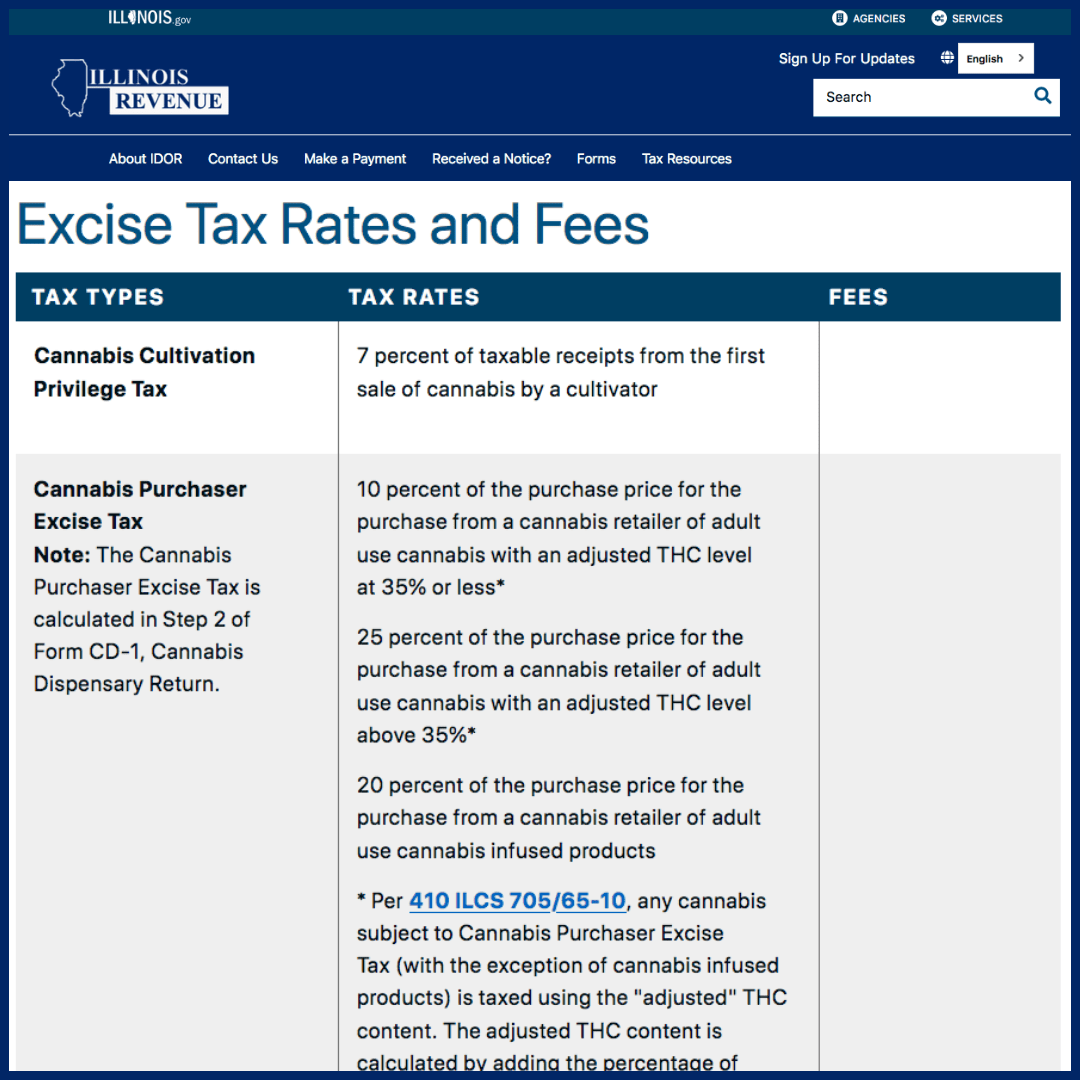

Currently, Illinois levies a multi-layered tax burden on cannabis consumers. Beyond the standard state and local sales taxes, there’s a Cannabis Purchaser Excise Tax that ranges from 10% to a whopping 25% depending on the THC content and product type. Specifically:

- 10% for cannabis with an adjusted THC level at or below 35%

- 20% for cannabis-infused products (like edibles)

- 25% for cannabis with an adjusted THC level above 35%

When you factor in cultivation privilege taxes, the 6.25% state sales tax, and local municipal and county cannabis retailers’ occupation taxes (which can be up to 3% in municipalities and 3.75% in unincorporated county areas), recreational customers can end up paying as much as 40% in taxes out the door. This punitive tax structure has several detrimental effects:

- Drives Consumers to the Illicit Market: When legal products are significantly more expensive, consumers are naturally incentivized to seek out cheaper alternatives from the unregulated market.

- Hinders Dispensary Growth and Profitability: High taxes directly impact dispensary sales volume and cart totals. Consumers are likely to buy less or choose lower-priced items when facing such steep costs. This directly curtails the potential for growth and profitability for all dispensaries, including the social equity licensees the state aims to support.

- Stifles Competition and Innovation: The high barrier to entry created by both licensing complexities and a heavily taxed market makes it harder for new businesses, especially social equity dispensaries, to compete with established, larger operators. This limits market diversification and ultimately lessens product variety and competitive pricing for consumers.

- Undermines Social Equity Goals: While the intention behind pausing licenses might be to help social equity businesses, the reality is that high taxes are a constant headwind. These businesses, often starting with less capital, are disproportionately affected by policies that depress sales and profitability. Providing a market where products are more affordable and accessible would be a far more effective way to empower these entrepreneurs.

A Better Path Forward: Tax Reform, Not License Pauses

Instead of hitting the brakes on new licenses, which merely delays the inevitable and creates uncertainty in the market, Illinois should aggressively pursue cannabis tax reform. Lowering the excise tax rates would:

- Increase Traffic and Higher Cart Totals: More competitive pricing would attract more consumers to legal dispensaries, leading to increased foot traffic and, crucially, higher average cart totals as consumers feel less of a financial pinch.

- Boost State Revenue (Long-Term): While a lower tax rate per item might seem counterintuitive, increased sales volume driven by affordability could ultimately lead to greater overall tax revenue for the state. This has been observed in other markets where more reasonable tax structures are in place.

- Empower Social Equity Dispensaries: By making the legal market more viable, lower taxes would directly benefit social equity licensees, allowing them to attract and retain customers, build their businesses, and achieve the very goals of economic empowerment the social equity program was designed for.

- Keep Sales in Illinois, Not Neighboring States: States like Michigan and Missouri have significantly lower cannabis taxes. For instance, Michigan has a flat 10% excise tax on recreational sales, and Missouri’s retail sales tax is 6%. This creates a powerful incentive for Illinois residents, particularly those near the borders, to cross state lines for more affordable cannabis. Reducing Illinois’ tax burden would help keep that revenue within the state, strengthening Illinois’ economy and supporting its licensed businesses.

Addressing the Medical Cannabis Dilemma

Beyond the general recreational tax issue, there’s a significant disparity that further complicates the market for medical patients. Medical cannabis patients in Illinois are only subject to a 1% state retailer occupational tax, a massive saving compared to recreational rates. However, medical patients are currently forced to shop at the relatively few designated medical dispensaries to receive this beneficial tax rate. This limits their access to a wider range of products and potentially better pricing offered at recreational-only or dual-use dispensaries that primarily cater to the recreational market.

To truly support all consumers and improve the flow of the market, the state should allow for a universal point-of-sale (POS) system feature that would enable any licensed dispensary to charge the medical tax rate to a verified medical patient, regardless of whether they are a “medical-only” or “dual-use” facility. This simple technological adjustment would:

- Improve Patient Access: Medical patients would no longer be geographically limited in where they can purchase their medicine at the reduced tax rate, increasing convenience and choice.

- Streamline Operations: Dispensaries wouldn’t need separate inventories or complex workarounds to serve both medical and recreational customers, leading to more efficient operations.

- Level the Playing Field for Dispensaries: All dispensaries, including the new social equity ones, could better serve the medical market, diversifying their customer base and increasing their potential for success.

Illinois has made significant strides in establishing a legal cannabis market. Now is the time to optimize it for long-term success and truly realize the economic and social equity benefits it promises. Fixing the tax problem – for both recreational consumers and medical patients – is not just about making cannabis cheaper; it’s about fostering a healthy, competitive, and equitable industry for everyone involved. Let’s un-pause progress and ignite prosperity by reforming Illinois cannabis taxes.

Stay in the loop with all things Illinois Cannabis by joining the Couch Lock’d Newsletter here!

Become a Couch Lock’d Member.

Want to meet more people in the community and see what everyone’s smoking on? Join our Telegram channel here.

Find our latest reviews here.

Hosting an event & need a consumption bar? Hit us up here.

Save money with our affiliate links here.

Get your Illinois Medical Card for $85 with our link here.