Good news is brewing in Illinois for medical cannabis patients, with a comprehensive “omnibus” bill, Senate Bill 2090, recently clearing the House Executive Committee. This legislative package, a compilation of previously stalled cannabis amendments, aims to iron out several kinks in the state’s cannabis program, from bolstering social equity efforts to streamlining operations for cultivators and dispensaries. But for medical patients, one particular provision stands out as a potential game-changer: the ability to purchase cannabis at the medical tax rate from any dispensary, not just medical-specific ones.

The fact that these cannabis amendments have been blocked previously, speaks volumes about the challenges of getting comprehensive cannabis reform through. This isn’t just about a single contentious issue; it often involves a delicate balancing act of interests among various stakeholders: existing cultivators and dispensaries, social equity applicants, patient advocates, and state regulators.

The Significance of the Medical Tax Rate

The current tax structure in Illinois heavily favors medical cannabis. Medical cannabis patients pay a state retail tax rate of just 1%, plus any applicable local retailers’ occupation taxes, which are generally lower or exempt for medical cannabis. In contrast, adult-use cannabis is subject to a 6.25% state sales tax, plus additional excise taxes based on THC potency (10% for flower with under 35% THC, 20% for infused products, and 25% for products over 35% THC), and further local taxes that can add up to another 3.75%.

This means a medical patient can pay significantly less for the same product compared to an adult-use customer. By allowing medical patients to purchase at any dispensary (adult-use or medical) at their preferential tax rate, the bill would:

- Increase Accessibility: Patients would no longer be restricted to the often fewer and less conveniently located medical-only dispensaries. This is a massive boon for patients, especially those in rural areas or with limited mobility.

- Expand Product Choice: Medical patients would gain access to the full inventory of adult-use dispensaries, which often have a wider variety of strains, products, and brands due to the larger adult-use market.

- Foster Competition: All dispensaries, regardless of their original license type, would be competing for medical patient business. This could lead to better pricing, improved customer service, and more patient-focused offerings across the board.

GTI’s Past Opposition: Why and What it Means

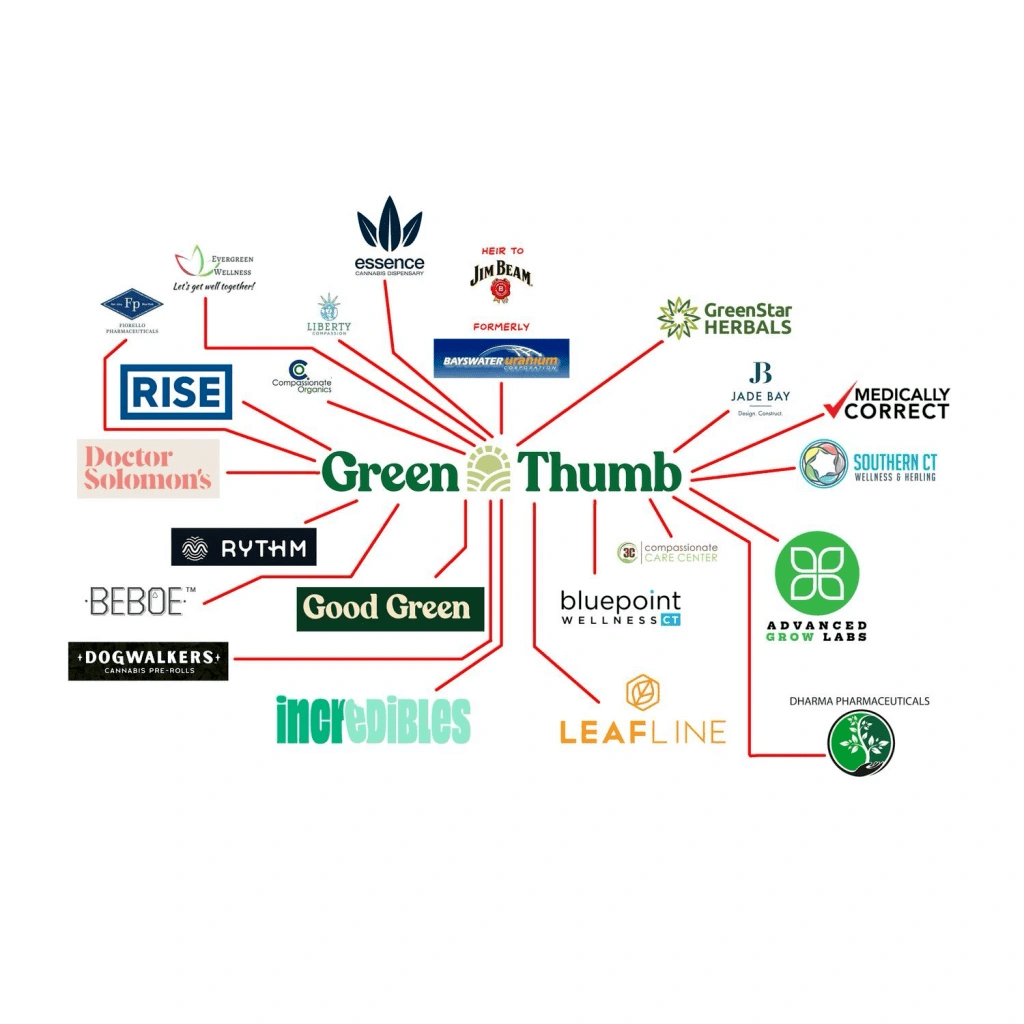

The mention of GTI lobbying to block this provision last May is a crucial detail. In 2023, a similar omnibus bill (often referred to by its House number, HB 2911) contained the medical patient tax rate expansion and other significant reforms. According to reports from sources like the South Side Weekly and MJBizDaily, powerful lobbyists, including those representing Green Thumb Industries (GTI), actively worked to derail the bill in the final hours of the legislative session.

Their reported rationale was often framed around “operational viability” or concerns about the bill’s comprehensive nature. However, many in the cannabis advocacy community, particularly the Cannabis Equity Illinois Coalition (CEIC), viewed GTI’s opposition as an attempt to protect their competitive advantage. GTI operates a significant number of dual-purpose dispensaries (licensed for both medical and adult-use sales) and likely wanted to maintain the distinction that incentivizes medical patients to shop at their dedicated medical facilities. Expanding the medical tax rate to all dispensaries would level the playing field and potentially dilute their existing stronghold on the medical market.

This previous lobbying effort led to calls for boycotts of GTI products and their RISE dispensaries by patient advocates. It highlighted the tension between large, established multi-state operators (MSOs) and the broader goals of patient access and social equity within Illinois’ cannabis program.

Other Key Amendments in SB 2090:

While the medical patient tax rate is a highlight, it’s worth reiterating some of the other important provisions that were part of this omnibus:

- Drive-Through Pickup: This would be a significant convenience, particularly for medical patients who may have mobility issues or prefer quick, contactless service.

- Prioritizing Medical Patients: The requirement for dispensaries to maintain adequate supply for medical patients and prioritize them during shortages addresses a long-standing concern among patients who have sometimes struggled to find their preferred medicine.

- Fees for Dispensaries and Cultivation Centers: The one-time $10,000 fee for dispensaries and increased renewal fees for cultivation centers are intended to funnel more funds into the Compassionate Use of Medical Cannabis Fund and the Cannabis Regulation Fund, respectively. These funds support the administration of the medical program and the broader regulatory framework.

- Craft Grower and Infuser Flexibility: Changes to camera storage requirements and license renewal periods could provide more operational flexibility for smaller, social equity-focused businesses.

- Eliminating Packaging Requirement: Removing the need to include the dispensary’s legal name on packaging could reduce costs and logistical burdens for dispensaries.

The Road Ahead

Even with committee approval, omnibus bills can face significant challenges. They are often subject to further amendments, intense debate, and last-minute negotiations.

The past opposition from powerful industry players like GTI underscores that the fight for expanded medical patient access is far from over. The legislative process is often a game of give-and-take, and what emerges from the final vote may look different from the current version of the bill. Patient advocates and cannabis community members will need to remain vigilant to ensure these crucial provisions for medical access are not diluted or removed.

Written by Patrick Vinson (Midwest Dazed)

Stay in the loop with all things Illinois Cannabis by joining the Couch Lock’d Newsletter here!

Want to meet more people in the community and see what everyone’s smoking on? Join our Telegram channel here.

Find our latest reviews here.

Hosting an event & need a consumption bar? Hit us up here.

Save money with our affiliate links here.

Get your Illinois Medical Card for $85 with our link here.